Why NOW is the best time to list your home in Kelowna

If you are thinking of selling your home in Kelowna, now is the best time to list. Top real estate team with RE/MAX Kelowna explains why you should list your home in Kelowna or area now instead of waiting until the spring.

Tracey Vrecko, one of the top agents with Quincy Vrecko and Associates explains why now is the time to list your home in Kelowna.

“The real estate market in Kelowna has been on a roller coaster ride over the past few years. With home sales soaring in 2017, just to soften up mid 2018 and into 2019. However, things are looking up for 2020.”

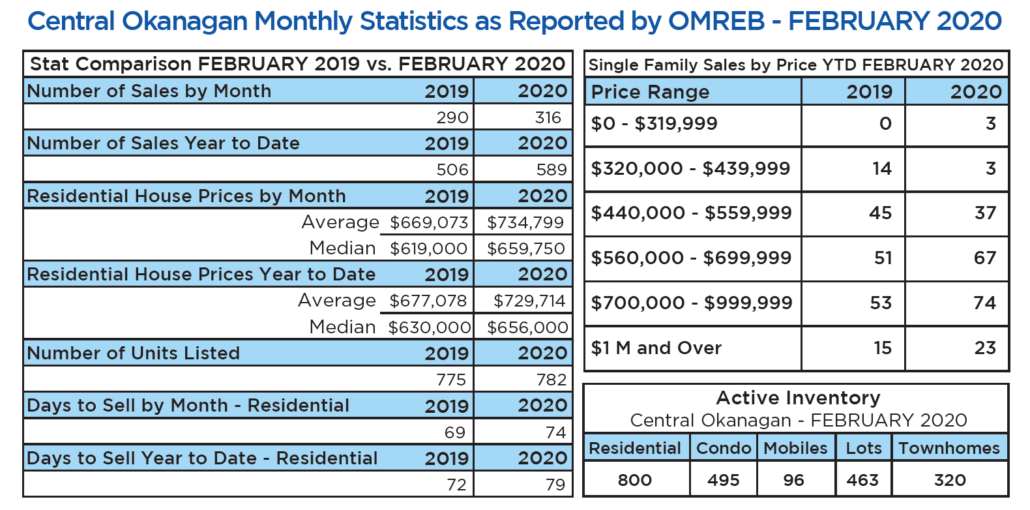

“The first 2 months have both posted an increase over the same time last year. Not only have real estate sales increased there has also been an increase in average home sale prices. This combined with a low inventory of homes for sale in Kelowna has made for a very strong start to 2020.”

“This is a great sign that buyers’ confidence in the real estate market is being restored” comments Tracey Vrecko

Vrecko goes on to say. “I would encourage anyone who is thinking of selling this year, to list your home in Kelowna as soon as possible. Inventory is low and there is a strong demand”

Year-to-date sales statistics:

- Sales: +16%

- Average home sale prices: +8.9%

The average home sale prices are higher this year partly due to an increase in luxury home sales. The number of luxury homes in Kelowna to sell in 2020 is up 53% over last year. This has had a major impact on the average home sale prices in Kelowna and surrounding areas. Overall, the market seems to be picking up at all price points.

With strong real estate sales numbers and low inventory in homes for sale in Kelowna, makes a perfect storm for home sellers. This is why the best time to list your home in Kelowna is NOW!

For a professional home market evaluation, call the team at Vrecko Real Estate Group. This top Kelowna real estate group offers tailored marketing programs. This dynamic team has a proven track record for achieving top dollar for their clients’ listings.

Construction Draws:

Construction Draws:

The City of Kelowna expects all new homes built after June 1, 2021, to be able to reach at least Step 3 of the program. This will mean the homes built in just over 2 years will be at least 50% more efficient! The city is offering building permit rebates as an incentive. In addition, Fortis BC is offering kickbacks to Kelowna homeowners for energy-efficient homes in Kelowna.

The City of Kelowna expects all new homes built after June 1, 2021, to be able to reach at least Step 3 of the program. This will mean the homes built in just over 2 years will be at least 50% more efficient! The city is offering building permit rebates as an incentive. In addition, Fortis BC is offering kickbacks to Kelowna homeowners for energy-efficient homes in Kelowna.

High-quality photos are incredibly important when listing your home for sale in Kelowna and the area. You get a split second to capture the attention of home buyers. If they don’t like what they see, your house listing could be passed by in an instant. If your MLS listing is not attracting potential buyers it could be as simple as changing the photos. The feature photo should be the best photo of the house. You want to stop that buyer on your listing. Invest in great photography to avoid having to do a price reduction in the future.

High-quality photos are incredibly important when listing your home for sale in Kelowna and the area. You get a split second to capture the attention of home buyers. If they don’t like what they see, your house listing could be passed by in an instant. If your MLS listing is not attracting potential buyers it could be as simple as changing the photos. The feature photo should be the best photo of the house. You want to stop that buyer on your listing. Invest in great photography to avoid having to do a price reduction in the future.

Why?

Why?